About us

CTI Tecnología y Gestión S.A. (S.M.E.) is a Spanish company whose share capital is owned by INFORMA D&B (https://www.informa.es) and by CESCE (http://www.cesce.com).

Our company name in English –Technology and Management– identifies us with the services we have been delivering to the banking, business and insurance sectors for 65 years..

The company’s business model is focused on Business Process Outsourcing and Technology Solutions, with a high level of specialisation in Data Management and Payment Systems, as well as Accounts Receivable Management.

Our goal is to provide service companies with high-quality technology, business process organisation and management of expert human resources, delivering efficacy, management capacity and flexibility in terms of costs and resources.

At CTI Tecnología y Gestión we target our activity towards the multi-sector market, developing tailor-made services for customers operating both nationally and internationally.

Our commitment and experience in the financial sector have made it possible for 98% of the financial institutions operating in Spain to rely on CTI services. We manage over 1.7 million transactions every day, and process 15% of the payments made in Spain.

At the same time, we act as a service provider for the business group CESCE, giving support to its companies in terms of flexibility and in their common policy on product and solution innovation and diversification.

During this decade, the Spanish economy began to improve as a consequence of the partial liberalisation of prices and trade, the recovery of the average income per capita, and –by the end of the period– the approval of the Stabilisation Plan.

Source: Agencia EFE. “1959. Passers-by in Puerta del Sol square”.

The economic measures adopted in the previous years, coupled with implementation of the development programme devised by the Government, opened up the economy to the business sector and international investment, curbing inflation and paving the way for a long period of economic growth, which drove profound changes in the country.

Source: Agencia EFE. “1966. Spain. Op Art Movement”.

Year 1964. The Origin of the Name

In August 1964, the CTI project was launched under the initiative of the French engineer Jean Louis Deguil Cotrelle, supported by an initially small team working at the company SUMAR, S.A. Only a month later, the company name was changed to CÁLCULO Y TRATAMIENTO DE LA INFORMACIÓN S.A. –DATA PROCESSING AND CALCULATION, in English– which is the origin of CTI acronym. Its original shareholders were SA IBERICA BEDAUX, holding 47.79%, with the remaining 52.21% distributed between 45 natural persons.

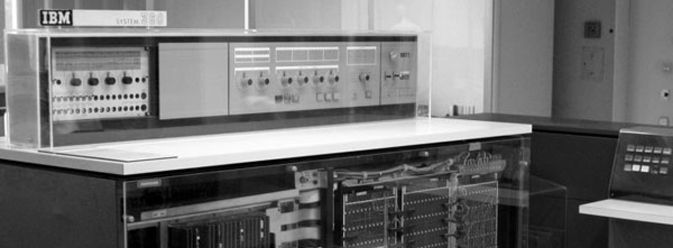

The business model consisted in creating a PROCESSING CENTRE to deliver IT services to the company. Among its customers was the large chain of department stores GALERÍAS PRECIADOS. Drilling and file sorting machines and a first large computer IBM 1401 were acquired and put into service.

In 1965 the company moved its headquarters to C/Guzmán el Bueno, in Madrid.

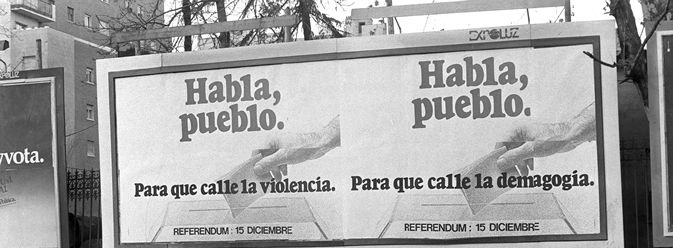

In 1973 the economy of western countries was struck by the so-called “oil crisis”. During the second half of the decade in Spain, production came to standstill, unemployment increased and inflation rose back to high levels. In that context, the Moncloa Pacts were signed

Source: Agencia EFE. “1976. Referendum on the Political Reform Act

Year 1972. First Expansion

In 1972, BANCO URQUIJO, a large industrial bank by then, and EXPLOSIVOS RIO TINTO acquired shares in CTI. CTI thus became the Processing Centre of EXPLOSIVOS RIO TINTO, and through its services, it came into contact with numerous customers of BANCO URQUIJO, expanding its activity along with the financial sector. New offices were opened in Barcelona and Bilbao, and IBM 360 and 370 units were acquired. During this period the company experienced a significant expansion.

Year 1975. First Document Digitisation

In 1975, CTI incorporated the DOCUMENT DIGITISATION process, being awarded, among others, an important contract with UNIÓN FENOSA.

Targeting the industry, Warehouse Management Systems, Accounting and Payroll Software, etc., were developed and supported with proprietary resources (software and hardware), working with customers such as EMPRESA NACIONAL CALVO SOTELO, REPSOL or CERVEZAS DAMM. CTI also collaborated with the Spanish State Administration on Electoral Registers and Censuses. Contracts were signed with Social Security, for management of the healthcare payroll of several provinces; with the National Employment Institute (INEM), for payment of unemployment benefits; and with the National Social Security Institute (INSS), for management and payment of social security contributions.

By the middle of the decade, in 1986, Spain joined the European Economic Community (EEC), opening up its economy and modernising its business sector in the face of strong international competition. This period was marked by a strong increase in foreign investment and infrastructure development, with the main economic indicators showing signs of considerable improvement.

The Early 80s. Leaders in Data Management

Back in the 80s, the archives of the National Register of Bad Debts (RAI) were one of the largest and most important databases on past due debts in Spain, being the major source of good standing-related information on companies. These databases were being managed manually by the different Clearing Houses throughout the national territory. The BANK OF SPAIN and the then-existing BANKING COUNCIL (CSB) called for a pilot test in Guipúzcoa for its automation, which was finally awarded to CTI. From then on, its use gradually expanded to the rest of the territory, until becoming the national macro database RAI. In the course of this process, CTI managed to outperform the strong competition from large technology operators, including IBM. This database continues being managed by the company for its owner, the INTERBANK COOPERATION CENTRE (CCI), with increased specialisation in DATA MANAGEMENT.

By then, CTI also signed agreements with the BANK OF SPAIN to manage all the activities of the CLEARING HOUSES in 38 provinces, taking on management of their resources, with manual exchange of payment transactions as its main activity. CTI applied technology to this process, delivering a significant level of optimisation, which helped it gain the trust of financial institutions. On its way towards evolution, an agreement was signed with the BANK TECHNICAL COOPERATION (CTB) –currently, CCI– to implement the first telematic bank clearing system, the “Multilateral Bank Exchange”, which connected all financial institutions in Spain with CTI, daily receiving and processing all payment transactions. At present, CTI continues leading management of an Advanced Centre for the CLEARING SYSTEM, supported by various PAYMENT SOLUTIONS.

Year 1985. Specialisation in Payment Document Management

By 1985, the company specialised in PAYMENT DOCUMENT MANAGEMENT SOLUTIONS for the financial sector (clearing houses, portfolio, eurocheques, etc.). The company went as far as to have 38 offices and about 1,000 employees. For several years, the company also managed a large project with the NATIONAL AGENCY FOR LOTTERIES AND BETTING OF THE SPANISH STATE, in coordination with the BANK OF BILBAO and the BANK OF BISCAY, deploying a dedicated infrastructure with three day shifts.

Following the strong growth and transformation experienced in the second half of the previous decade, the Spanish economy entered a recession in 1992, and unemployment climbed significantly. The impact of the Treaty on European Union or the Maastricht Treaty and Spain’s joining the Monetary Union were determining factors for the transformation of the Spanish economy, especially by the end of the decade with economic growth and job creation. In 1999 the euro became the legal tender in Spain, although the old peseta was not replaced until 2002.

Source: Agencia EFE. “1992. High-speed train (AVE) opening trip”.

The Early 90s. Changes in the Company Name and Share Capital

The Early 90s. Changes in the Company Name and Share Capital

By the end of the 80s, and in the first half of the 90s, CTI’s share capital went through several changes, incorporating CITIBANK and FRANCE TELECOM. Its company name also had a few changes, to DIAGRAM CTI, S.A. in 1994, and later on to DIAGRAM SERVICIOS DE VALOR AÑADIDO, S.A. in 1996, while in 1995 its headquarters were moved to C/Proción, in Aravaca, Madrid.

That year, the BANK OF SPAIN announced the implementation of a new BANK CLEARING system –the NATIONAL ELECTRONIC CLEARING SYSTEM (SNCE)–, which would start operating at the beginning of 1999, leading to a profound transformation of the model in place until then. The company adapted to the new SNCE model developed by the BANK OF SPAIN, and signed a number of agreements with some banks, first with CHASE MANHATTAN BANK (today, JP MORGAN), and later on with others, including CAJAMAR. With that, the company managed to retain and reaffirm its position in the new clearing system (SNCE), currently supporting transactions of over 50 financial institutions.

Year 1997. Informa S.A. Takes Over the Company

In 1997, INFORMA, S.A. took over the company, which recovered and completed its name as CÁLCULO Y TRATAMIENTO DE LA INFORMACIÓN CTI, S.A. CTI maintained its business approach and cooperated with INFORMA to successfully position its offer in the financial sector.

.

During the first decade of this century, the Spanish economy developed as part of the Economic and Monetary Union (EMU). In the first half, it continued with the growing trend from the previous period. By the second half, in 2007, some indicators had begun to show a change of trend, which harshly revealed itself in 2008. That was the beginning of the so-called “2008 economic crisis”, which had a big, serious impact both nationwide and internationally, turning high growth rates into recession and slowdown, and badly hitting employment.

Year 2002. Transfer to Current Location

In connection with the RAI project and its use by the financial sector, in 2002 CTI signed a contract with EXPERIAN for delivery of global technology services applied to its product EXPERIAN BUSINESS BUREAU (formerly, BADEXCUG) – a macro database on banking and multi-sector bad debts. Under these contracts, CTI has been providing EXPERIAN with HOSTING services on a MAINFRAME platform and OPEN SYSTEMS, and with HOUSING services for open systems and communications. By late 2002, the company moved its registered offices to Avenida de la Industria, in Alcobendas (Madrid).

Year 2003. Creation of CTC

In 2003, the companies that make up CESCE Group (CESCE, INFORMA and CTI) decided to bring all their technology architecture and its administration and operation together into a project initially called SHARED SERVICES CENTRE (CSC), and later on, SHARED TECHNOLOGY CENTRE (CTC). The CTC was managed by CTI, which gradually took on responsibility for technological and human resources of the Group companies.

That same year, CTI began to provide a new service to the financial sector: the BANK VERIFICATION service, aimed at the credit card segment of the consumer credit sector. CESCE became a shareholder of CTI after purchasing 60% of its share capital from INFORMA.

Year 2006. SWIFT Network Services

In 2006 CTI reached an agreement with CAJA DE INGENIEROS to enhance its international payment system solutions, making available to the market the connection, integration and operability services of the SWIFT network (SOCIETY FOR WORLD INTERBANK FINANCIAL TELECOMMUNICATION), used by thousands of financial institutions, securities organisations and corporate clients from over 200 countries to process their payment orders and transactions in a direct, fast, secure and reliable manner.

By the end of the year, CESCE Group companies decided to change the operating structure of the SHARED TECHNOLOGY CENTRE (CTC), creating an independent operating unit to service the Group companies. Thus arose GRUPO CESCE SERVICIOS TECNOLÓGICOS (GCST, AIE), integrating all the resources allocated to the CTC. CTI remained responsible for marketing the technological capacities of GCST, AIE.

Year 2007. Change in the Share Capital

In 2007, there was a change in its share capital, allocating 50.80% to INFORMA D&B, and 49.20% to CESCE.

Year 2008. New Business Approach

EIn 2008 CTI set itself two major objectives as its business strategy to target its offer and services: to integrate its business model with the business model of CESCE Group companies, providing value added and operational flexibility, and to diversify the customer portfolio by targeting the offer towards the business sector. These approaches helped to increase its capacity to deliver services, especially ACCOUNTS RECEIVABLE MANAGEMENT, a solution comprising different service modules for preventive protection of trade receivables, from issuance until maturity, and out-of-court management of bad debts

Year 2009. Management of the Auxiliary Deposit System

At the beginning of 2009, the company incorporated the AUXILIARY DEPOSIT SYSTEM (SDA) to its management services, a process enabling financial institutions to process their cash requests and deliveries to meet their global needs. To that end, the system coordinates the actions of the BANK OF SPAIN with security and transport companies and the Auxiliary Deposits of the BANK OF SPAIN in each province.

Source: Agencia EFE. “2011 Spain. Lux Greco, Toledo”.

Year 2010. Change of Company Name

At the beginning of the decade, in 2010, the company changed its name to CTI TECNOLOGÍA Y GESTIÓN, S.A., as well as its logotype and slogan, with a view to aligning the corporate image with the current business reality and the strategic goals set.

That same year, CTI began to offer the financial sector the CENTRALISED CASH MANAGER (CACE) service for cash management (request, delivery, minimum stock) at offices, ATMs, etc., in coordination with security and transport companies.

Year 2013. The CENTRALISED CASH MANAGER ENHANCING service was created.

In 2013, CTI, in collaboration with the UNIVERSITY OF DEUSTO, supplemented the CENTRALISED CASH MANAGER (CACE) service with the ENHANCING option for the cash balance existing at each point, by applying a mathematical predictive model to significantly reduce the global cost of cash management.

Over these years, new services aimed at the multi-sector market were incorporated to the company’s activity, such as MARKETING services, integrating databases in coordination with INFORMA D&B, telemarketing services, sales appointment setting, electronic or postal mailing, data file enrichment and integration, etc.

On the other hand, CTI reached agreements with LOGALTY, a TRUST SERVICE PROVIDER primarily owned by INFORMA D&B, to market its electronic procurement, notification and publication solutions, with fully-guaranteed recognition as legal evidence. With that, the market was offered the possibility to switch from paper-based to electronic systems for the entire contractual process: contracts, invoices, etc.

Finally, another highlight of this year was the contract signed by the Group companies with IBM GSE to enhance the continuous and necessary technological upgrade of all their information system architecture.

Year 2014. Purchase of Onerate Consulting

In June 2014, the company Onerate Consulting was fully acquired to offer the market a global solution for accounts receivable management. Through this company, the market is offered specialised financial CONSULTING on credit sale management and control processes and policies, both within and outside Spain, a tailor-made TECHNOLOGY PLATFORM to give support to management, and PROFESSIONAL SOLUTIONS AND EQUIPMENT to optimise the model in place.

- Technology platform for credit risk management.

- Credit management. Financial consulting services for accounts receivable management planning, integrated with managed support services

On the other hand, in coordination with INFORMA D&B, and on the legal advice of DELOITTE, CTI offers the entire financial sector and other interested companies a Specialised Back Office Service as per FATCA (Foreign Account Tax Compliance Act), with Call Centre and Document Management Centre services dedicated exclusively to handle this important project arising from the US laws for the detection of tax fraud and its application under OECD (CRS) standards, also incorporated to the project.

Year 2015. 60th Anniversary

Not many companies in our country can boast about turning 60 years. This is only possible by maintaining an adaptive capacity and customers’ trust.

According to a study conducted by INFORMA D&B on the age or survival of companies in Spain, the average operating time of Spanish companies is 11.69 years, and only 1.25% were set up before 1975, with 41 companies from the 19th century surviving to date.